The Republic of South Sudan became the world’s newest nation and Africa’s 55th country on July 9, 2011, following a peaceful secession from The Sudan through a referendum in January 2011. Although South Sudan has vast and largely untapped natural resources, beyond a few oil enclaves, it remains relatively undeveloped, which offers investors significant opportunities in multiple sectors.

According to the World Bank, the country’s growth domestic product (GDP) per capita in 2014 was $1,111m. Outside the oil sector, livelihoods are concentrated in low productive, unpaid agriculture and pastoralists work, accounting for around 15% of GDP. In fact, 85% of the working population is engaged in non-wage work, chiefly in agriculture (78%). The country is very young with two-thirds of the population under the age of 30. Almost 83% of South Sudanese resided in rural areas.

Labor Regulations in South Sudan

South Sudan can be a complex and challenging place for human resources, not least because the country is still operating under the jurisdiction of the Labor Act of 1997 that relates to Sudan as a whole, prior to South Sudan’s independence. The Labor Act can be found here (download) but it can be wise to seek additional support from the South Sudan Ministry of Labor, or consult Imatong Employment Solutions and we can help you to navigate some of the potential pitfalls you could encounter working with employment law in South Sudan.

Some key elements to consider include:

- Notice period – all staff on contract must be given one month’s notice prior to the end of their contract OR be paid one month in lieu of notice. This must be done irrespective of the end date of the contract. For example; Even if a staff member has a contract ending on 31 March 2017, they MUST be notified one month in advance that the contract will end.

- Social Insurance – all organisations are required to pay social insurance for their staff. Currently, the law states that 17% must be contributed by the employer, and 8% by the employee. This money should be accrued on behalf of the staff member and paid out on the termination of employment with any given company/organization. Not accruing this money can have serious implications for any organization/business as their staff have the right to take them to the Labor Office for non-compliance.

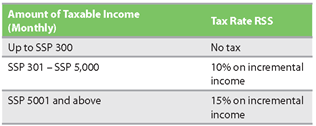

- Tax – Personal insurance tax (PIT) must be accrued, and paid to the government, for all employees. The PIT scales are as follows:

- All job advertisements must be approved by the relevant State Ministry of Labor (MoL) before they are disseminated. The MoL stipulates the length of time for which a job advert should be shared before the deadline closes. They may also comment on aspects such as the qualifications specified as necessary, and other key issues. Any advert that does not receive enough qualified applicants and is re-advertised, must be again approved by the Ministry of Labor.

- Contracts – it can either be for a definite or indefinite period. Duration of a definite contract shall not exceed two (2yrs) whereas an indefinite contract will not clearly state therein that it is for a specific period of time.

- Probation period – it should not exceed three (3) months.

- Appeals – A worker/employee may appeal to the competent authority against the order of termination of the contract of service within a period of two weeks starting from the date of a written final notification by the employer.

There are a number of other regulations that NGOs and businesses must adhere to when working in South Sudan. Get in contact with us to see how we can help you ensure your organization is compliant with all regulations.