South Sudan can be a complex and challenging place for human resources, not least because the country is still operating under the jurisdiction of the Labor Act of 1997 that relates to Sudan as a whole, prior to South Sudan’s independence. A link to the Labor Act can be found below, but it can be wise to seek additional support from the South Sudan Ministry of Labor, or consult Imatong Employment Solutions and we can help you to navigate some of the potential pitfalls you could encounter working with employment law in South Sudan.

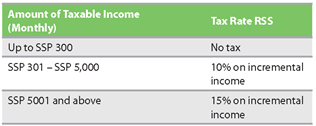

Some key elements to consider include: